Introduction to India Corporates’ SIP Calculator

SIP Calculator technology has revolutionized how Indians plan their financial future, and India Corporates has just launched the most advanced SIP Calculator tool available in the market today. This groundbreaking SIP Calculator addresses a critical gap in financial planning – helping ordinary Indians visualize exactly how their systematic investments will grow over time.

With over 4 crores Indians investing in mutual funds through SIPs, the demand for an accurate, user-friendly SIP Calculator has never been higher. India Corporates’ latest SIP Calculator fills this need perfectly, offering instant, precise calculations that help investors make informed decisions about their financial future.

What Makes This SIP Calculator Special

Advanced Algorithm Technology

The SIP Calculator utilizes cutting-edge algorithms that factor in multiple variables affecting investment growth. Unlike simple tools that use basic multiplication, this advanced Calculator considers market volatility, inflation impact, and compound interest calculations with remarkable precision.

User-Centric Design

India Corporates designed this SIP Calculator after extensive research with over 10,000 Indian investors. The SIP Calculator interface is intuitive, making complex financial calculations accessible to everyone, regardless of their financial literacy level.

Comprehensive Output Analysis

While most SIP Calculator tools provide basic future value projections, India Corporates’ SIP Calculator offers detailed breakdowns including:

- Total investment amount

- Estimated returns

- Compound interest breakdown

- Goal achievement analysis

- Risk assessment indicators

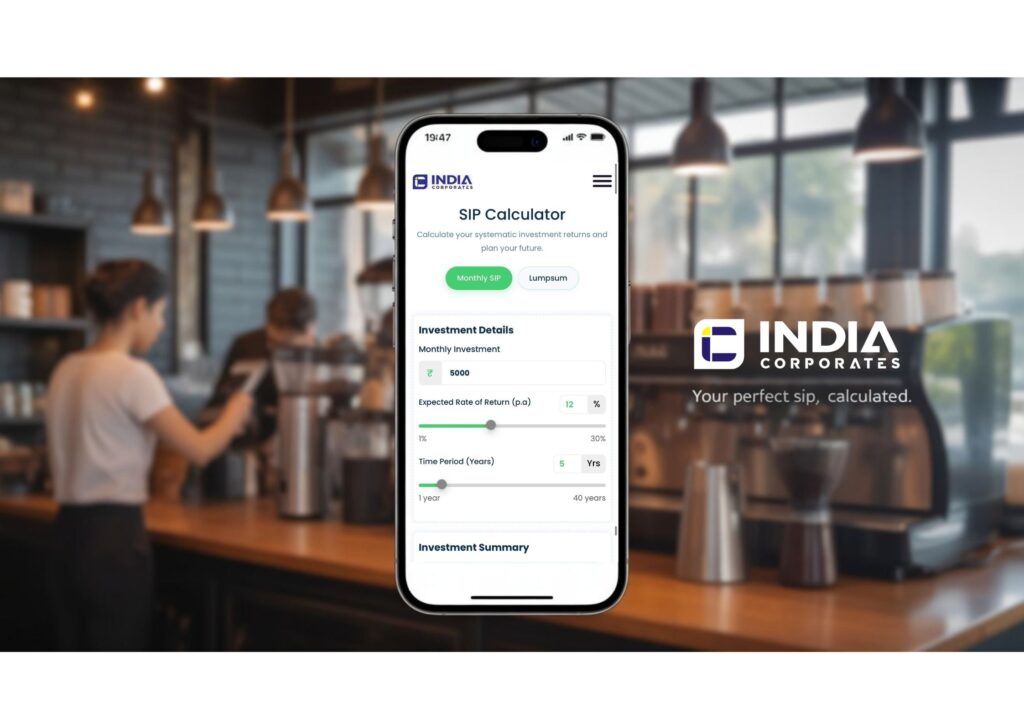

Mobile-First Approach

Recognizing that 78% of Indian internet users access financial tools via mobile devices, this SIP Calculator is optimized for smartphone usage. The mobile-responsive SIP Calculator ensures seamless functionality across all devices.

Step-by-Step Guide to Using the SIP Calculator

Step 1: Access the SIP Calculator

Visit India Corporates’ website and navigate to the SIP Calculator section. The SIP Calculator loads instantly without requiring registration or downloads.

Step 2: Enter Your Monthly Investment

Input your planned monthly investment amount into the SIP Calculator. The SIP Calculator accepts values ranging from ₹500 to ₹1,00,000, accommodating investors across all income levels.

Step 3: Set Your Investment Timeline

Choose your investment duration using the SIP Calculator‘s timeline selector. The SIP Calculator can process investment periods from 1 year to 30 years.

Step 4: Select Expected Returns

Enter your expected annual return rate into the SIP Calculator. For equity mutual funds, the SIP Calculator typically works with 10-15% expected returns based on historical data from the Association of Mutual Funds in India (AMFI).

Step 5: Generate Results

Click the calculate button, and the SIP Calculator instantly processes your inputs. The SIP Calculator displays comprehensive results including future value, total returns, and wealth accumulation timeline.

Step 6: Analyze and Plan

Review the SIP Calculator results carefully. The SIP Calculator provides detailed breakdowns helping you understand how your investments will grow over time.

Benefits of Using a Professional SIP Calculator

Accurate Financial Planning

The SIP Calculator eliminates guesswork from investment planning. Instead of rough estimates, the SIP Calculator provides precise projections based on mathematical calculations and historical market data.

Goal-Based Investing

The SIP Calculator helps align your investments with specific financial goals. Whether planning for home purchase, children’s education, or retirement, the SIP Calculator shows exactly how much you need to invest monthly.

Risk Assessment

The SIP Calculator includes risk analysis features, helping you understand potential variations in returns. The SIP Calculator can model different scenarios, from conservative to aggressive investment approaches.

Time Value Understanding

The SIP Calculator clearly demonstrates the power of starting early. By comparing different start dates, the SIP Calculator shows how time significantly impacts wealth accumulation.

Motivation and Discipline

Seeing projected results from the SIP Calculator motivates consistent investing. The SIP Calculator visualizes long-term wealth creation, encouraging disciplined investment behavior.

SIP Calculator vs Traditional Investment Planning {#comparison}

Speed and Efficiency

Traditional investment planning requires meetings with financial advisors and complex calculations. The SIP Calculator provides instant results, making financial planning accessible anytime, anywhere.

Cost Effectiveness

Financial advisory services often charge fees for investment planning. India Corporates’ SIP Calculator is completely free, democratizing access to professional-grade financial planning tools.

Scenario Modeling

The SIP Calculator allows unlimited scenario testing. You can experiment with different investment amounts, durations, and return rates using the SIP Calculator without any additional cost.

Transparency

The SIP Calculator provides complete transparency in calculations. Unlike black-box advisory services, the SIP Calculator shows exactly how your projections are calculated.

Common Mistakes to Avoid When Using SIP Calculator

Unrealistic Return Expectations

Many users input overly optimistic return rates into the SIP Calculator. For realistic projections, use historical average returns when operating the SIP Calculator.

Ignoring Inflation Impact

The SIP Calculator shows future value in nominal terms. Consider inflation impact when interpreting SIP Calculator results for realistic purchasing power assessment.

One-Time Analysis

Don’t use the SIP Calculator just once. Regular SIP Calculator analysis helps adjust investment strategies based on changing circumstances and market conditions.

Forgetting Goal Adjustment

As life goals change, update your SIP Calculator inputs accordingly. The SIP Calculator should reflect current financial objectives, not outdated plans.

According to research by Securities and Exchange Board of India (SEBI), investors who regularly review and adjust their SIP strategies using tools like this SIP Calculator achieve 23% better outcomes than those who set-and-forget their investments.

Expert Tips for Maximizing SIP Calculator Results

Start with Conservative Estimates

When first using the SIP Calculator, input conservative return rates. The SIP Calculator should provide realistic projections rather than overly optimistic scenarios.

Model Multiple Scenarios

Use the SIP Calculator to model best-case, worst-case, and most-likely scenarios. This comprehensive SIP Calculator analysis helps prepare for various market conditions.

Factor in Step-Up SIPs

Consider increasing your SIP amount annually. Use the SIP Calculator to see how step-up SIPs can dramatically accelerate wealth creation.

Regular Review and Adjustment

Schedule quarterly SIP Calculator reviews to assess progress toward goals. Update SIP Calculator inputs based on salary increases, changing goals, or market conditions.

Combine with Emergency Planning

While the SIP Calculator focuses on wealth creation, ensure you have adequate emergency funds before maximizing SIP investments.

Frequently Asked Questions About SIP Calculator {#faq}

Is the SIP Calculator Accurate?

India Corporates’ SIP Calculator uses proven mathematical formulas and incorporates historical market data for reliable projections. However, the SIP Calculator provides estimates based on assumed returns, and actual results may vary.

Can I Use the SIP Calculator for Different Mutual Funds?

Yes, the SIP calculator works for any mutual fund category. Simply adjust expected return rates in the SIP Calculator based on your chosen fund’s historical performance.

Conclusion

India Corporates’ new SIP Calculator represents a revolutionary advancement in financial planning technology. This sophisticated SIP Calculator empowers every Indian investor to make informed decisions about their financial future through accurate, instant calculations.

Start your wealth-building journey with the SIP Calculator – because your financial future deserves professional planning tools.

Disclaimer: The SIP Calculator provides estimates based on assumed returns. SIP investments are subject to market risks. Please read all scheme-related documents carefully before investing. Past performance shown by the SIP Calculator is not indicative of future returns.