India Corporates introduces the most comprehensive SIP Calculator designed specifically for Indian investors. Our advanced SIP Calculator helps you estimate potential returns from systematic investment plans and make informed financial decisions for your future.

What Is India Corporates SIP Calculator?

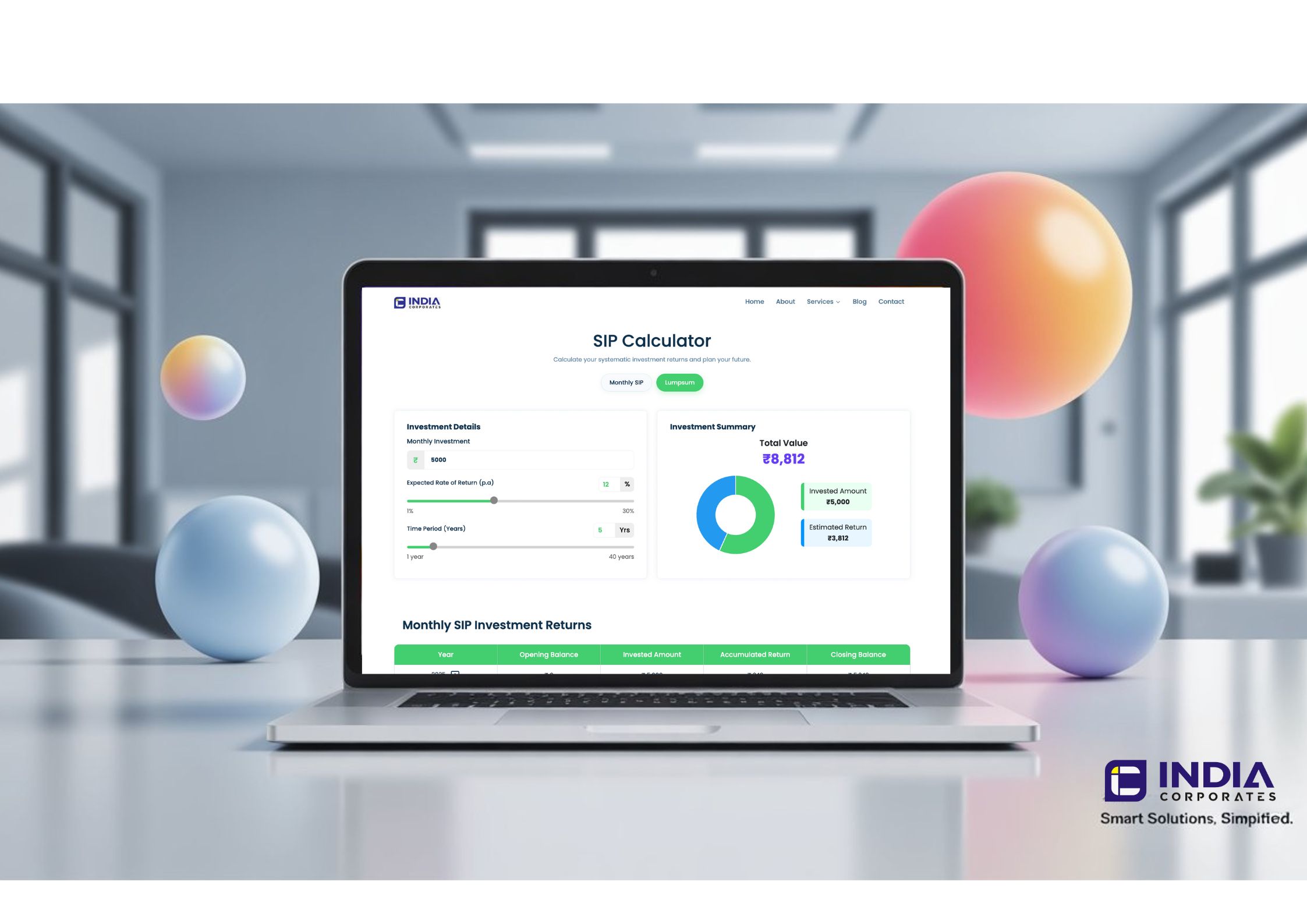

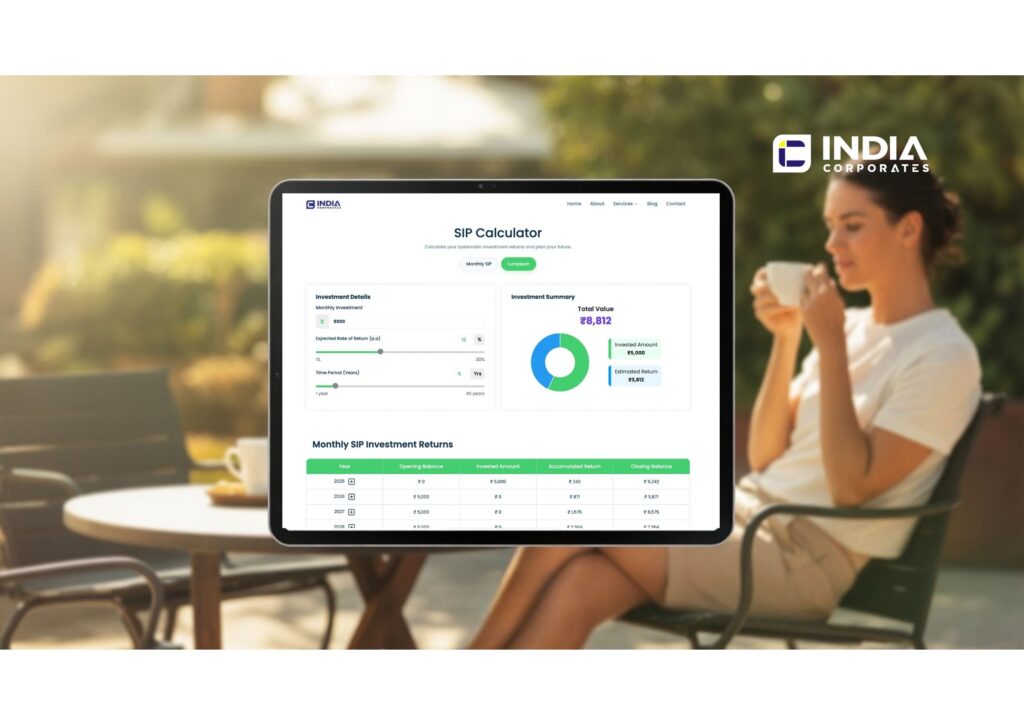

An SIP Calculator by India Corporates is a powerful tool that allows investors to gauge possible returns on their SIP mutual fund investments. By entering the investment amount, period, and probable rate of return, users can analyze potential returns and make rational financial choices. Although actual returns differ based on market conditions, our SIP Calculator provides sound estimates of investment growth, making it essential for efficient financial planning.

How Can India Corporates SIP Calculator Help You?

Using India Corporates SIP Calculator, investors can estimate wealth generated from monthly SIP investments and gain clear views of expected returns at maturity. Key advantages of our SIP Calculator include the ability to compare multiple investment scenarios. By adjusting inputs like SIP amount, tenure, and return rate, investors can evaluate various strategies using our SIP Calculator and choose options that best suit their financial objectives.

Our SIP Calculator offers visual representation of compounding power through graphs and charts, making it easier to understand wealth accumulation over time. The SIP Calculator supports goal-based investing by helping users set realistic financial targets—such as building retirement funds, purchasing homes, or funding children’s education—and estimating required monthly investments to achieve them.

Real Example Using India Corporates SIP Calculator

Consider Rajesh, a 30-year-old professional planning for retirement using India Corporates SIP Calculator:

Investment Details:

- Monthly SIP Amount: ₹15,000

- Investment Period: 25 years

- Expected Annual Return: 12%

- Investment Frequency: Monthly

India Corporates SIP Calculator Results:

- Future Value: ₹2,84,72,385

- Total Investment: ₹45,00,000 (15,000 × 12 × 25)

- Potential Returns: ₹2,39,72,385

This demonstrates how India Corporates SIP Calculator helps visualize long-term wealth creation potential through systematic investing.

Benefits of Using India Corporates SIP Calculator

Disciplined Investment Planning

India Corporates SIP Calculator encourages consistent wealth creation by showing exact monthly requirements for financial goals. Regular use of our SIP Calculator builds investment discipline and eliminates market timing needs.

Rupee Cost Averaging Benefits

Our SIP Calculator demonstrates how systematic investing reduces market volatility impact. When you invest regularly through SIPs calculated using our SIP Calculator, you buy more units when prices are low and fewer when prices are high.

Goal-Oriented Wealth Building

India Corporates SIP Calculator helps align investments with specific financial objectives. Whether planning for children’s education, home purchase, or retirement, our SIP Calculator shows precise monthly investment requirements.

Power of Compounding Visualization

The SIP Calculator clearly illustrates how early and regular investing allows earnings to generate further returns. Our SIP Calculator demonstrates how starting early significantly impacts final wealth accumulation.

Types of SIP Investments You Can Calculate

India Corporates SIP Calculator works with various SIP types:

Regular SIP: Fixed monthly investments calculated through our SIP Calculator for consistent wealth building.

Step-Up SIP: Gradually increasing SIP amounts that our SIP Calculator can project for growing income scenarios.

Flexible SIP: Variable investment amounts that our SIP Calculator can accommodate for irregular income patterns.

Goal-Based SIP: Target-oriented investments that our SIP Calculator optimizes for specific financial objectives.

Common Mistakes to Avoid with SIP Calculator

Starting Late

India Corporates clearly shows how starting early maximizes compounding benefits. Delaying investments reduces time for wealth appreciation, limiting long-term building potential.

Ignoring Due Diligence

Using our SIP Calculator without proper fund research may result in poor returns. Always combine SIP Calculator projections with thorough fund analysis.

Stopping During Market Downturns

Our SIP Calculator assumes consistent investing. Stopping SIPs during market volatility undermines the averaging benefits that our SIP Calculator factors into projections.

Not Reviewing Investments

Regularly reassess your investments alongside SIP Calculator projections. Market conditions change, and periodic review ensures your strategy remains aligned with goals.

SIP vs Lumpsum: What India Corporates SIP Calculator Shows

India Corporates SIP Calculator can compare both investment approaches:

SIP Investment Benefits:

- Rupee cost averaging reduces volatility

- Smaller monthly commitments suit most budgets

- Builds investment discipline over time

- Our SIP Calculator shows steady wealth accumulation

Lumpsum Investment Characteristics:

- Requires significant upfront capital

- Higher potential returns in bull markets

- Greater exposure to market timing risks

- Suitable for experienced investors with available funds

How to Use India Corporates SIP Calculator

Step 1: Visit India Corporates website and access our free SIP Calculator

Step 2: Enter your monthly SIP amount in the SIP Calculator

Step 3: Set investment duration using our SIP Calculator interface

Step 4: Input expected annual return rate in the SIP Calculator

Step 5: Review comprehensive results from India Corporates SIP Calculator

Step 6: Adjust parameters to optimize your investment strategy

Advanced Features of India Corporates SIP Calculator

Multiple Scenario Analysis

Our SIP Calculator allows comparing different investment amounts, durations, and return rates simultaneously. This feature helps identify optimal investment strategies for your financial situation.

Goal-Based Calculations

India Corporates SIP Calculator can work backwards from target amounts, showing required monthly investments to achieve specific financial goals within set timeframes.

Tax-Efficient Planning

Our SIP Calculator can incorporate tax-saving mutual fund options, helping optimize both wealth creation and tax benefits under Section 80C.

Conclusion

India Corporates SIP Calculator empowers investors with accurate projections and comprehensive analysis tools for successful wealth building. Our free SIP Calculator eliminates guesswork from investment planning and provides clear roadmaps for achieving financial objectives.

Whether you’re starting your investment journey or optimizing existing portfolios, India Corporates SIP Calculator offers the insights needed for informed decision-making. Use our SIP Calculator today to discover your wealth-building potential through systematic investing.

Start planning your financial future with India Corporates SIP Calculator – because every investment decision deserves professional-grade analysis tools.